June 19,2025 - Volatility Unleashed: Trading Amid Iran–Israel Tensions

Master pre‑war market behavior and high‑conviction swing setups for ES, NQ, AMZN, SLV & more. More Take Profit Trader giveaways are coming soon. Don't miss out, subscribe now!

Recent Wins & Profits 📈

The markets teach us repeated lessons about patience and the transformative power of disciplined execution. Yesterday's exclusive $HIMS put sell recommendation from our subscriber chat delivered over 20% profit. Opportunities continue to emerge when we align preparation with conviction. Similarly, our DKNG calls soared past the high $39s for 50%+ gains, reminding us that sustained success flows from methodical position sizing and educated risk taking, rather than emotional gambling!

These wins are more than just numbers on a screen, they validate the deeper principle that growth happens when we trust the process over the immediate gratification of quick trades. Each win builds, our accounts, and our character as a trader. Teaching us that resilience and patience create a foundation for lasting transformation in both the markets and life…

The Iran-Israel Reality & Why The Markets Care

As tensions escalate between Iran and Israel, with Trump's recent meetings hinting at potential U.S. military involvement, we're witnessing a familiar market pattern unfold. History teaches us that geopolitical volatility often drives ES and NQ futures swings more dramatically than political rhetoric itself.

Markets don't trade on fear, they trade on uncertainty transitioning to clarity. Pre-war environments typically create initial selling pressure as institutions hedge risk, followed by swift recoveries once military actions begin and outcomes become measurable. The SP500 futures (ES) and Nasdaq futures (NQ) become particularly sensitive during these periods, as algorithmic trading amplifies every single headline.

Remember: volatility is opportunity disguised as chaos. Those who maintain disciplined frameworks/guidelines will do better than those who react emotionally. More actionable ES (SPY) trades below to help in these chaotic markets.

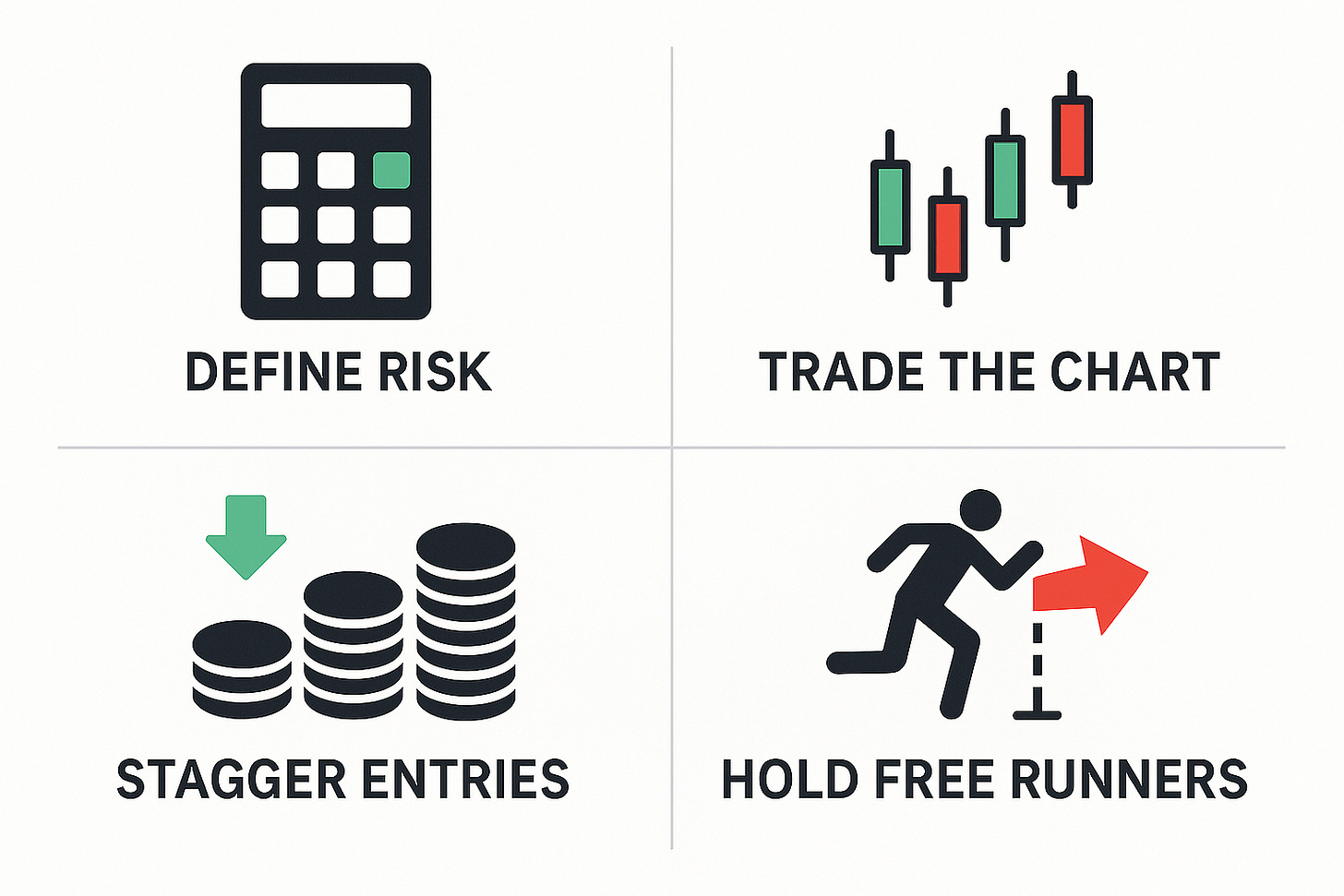

Your 4 Key Trading Principles for Volatile Markets

1. Define Your Risk

Always calculate your maximum loss before entry. You don’t want to limit your upside, and always be sure to give your winners room to breathe. But, when you know exactly what you're risking, fear can transform into focused execution.

2. Trade the Chart

Headlines create emotions, but charts reveal intentions. Ignore geopolitical noise until your technical setups confirm the narrative. The market's truth lies in price action, not in media predictions.

3. Consider Staggered Entries

Deploy capital in measured amounts at predefined zones. This approach allows you to average into strength rather than chase momentum. Some moves may happen before you can get a “full position”, but remember capital preservation is more important than profit maximization!

4. Hold "Free Runners", Let Your Success Compound

Lock partial profits to eliminate risk, then let your winners teach you about the power of patience. Some of your greatest gains will come from positions you almost closed too early.

This Week's High-Conviction Setups 💰

AMZN (Amazon) A Resilience Play

After failing its breakout attempt on 6/11, Amazon's pullback on 6/18 offers us a clean re-entry opportunity. Setbacks often create our greatest advances…

Entry: Under $213

Stop Loss: Close under $209

🎯 Target 1: $217.96 resistance

🎯 Target 2: $220+ extending to $225 on strong breakout

This setup is patience rewarded .

SLV (Silver)

Precious metals pullback to prior support zones reduces our risk while maintaining upside potential. A perfect spot for strategic positioning during uncertain times.

Entry: At or below $33

Stop Loss: $32.75

🎯 Target 1: $34.80

🎯 Target 2: $35.75

Sometimes the most reliable paths forward require returning to solid foundations.

NVDA Innovation Conviction

AI demand continues surging, with Saudi AI partnership news on 6/17 providing fresh catalyst. This is a bet on human ingenuity and technological transformation.

Eyeing 8/15 $150 calls

Entry: Ideally under $145.50

Stop Loss: Close under $143

🎯 Target 1: $148.50

🎯 Target 2: $150+

Backed by Morgan Stanley's raised data-center forecasts and Wedbush's bullish outlook, this trade aligns with the future we're building.

ES (E-mini S&P 500 Futures, ESU2025) Levels & More

Since April 6th, every significant dip has been bought. The 6/18 FOMC session provided clean level-to-level moves, creating predictable zones for disciplined entries.

Support Zones: 5979-5982, then 5962, then 5945

Entry: Long on failed breakdown off 5979-5982 support

Stop Loss: Close under 5945

Target 1: 5993 (recovery move)

Target 2: 6000+ extending to 6050 magnet level

The ES teaches us that systematic approaches often outperform emotional reactions to volatility.

Essential Tools for Your Trading Journey

Your growth accelerates when you equip yourself with professional-grade resources:

TradingView – Advanced charting & custom alerts 📈📉

Take Profit Trader – 30% OFF + no fees (code ALPINE) 💰

Robinhood Gold – 4-4.5% APY on idle cash 💵

Your Path Forward

Enter these setups by market close on June 20th, 2025, or set alerts for next week. More importantly, approach each trade as a lesson in discipline and growth. Reply with your chosen trades and P/L updates, let’s continue building the community around our collective transformation.

If you haven’t yet, checkout the Market Insights & Trading Trends FREE pre-market checklist to make sure you are dialed in and ready to trade before the markets open!

Every trade is an opportunity to become the trader and person you're meant to be. Trust the process, embrace the journey, and let patience be your greatest edge.

- Kyle

P.S. Thank you for all the likes & restacks, we put 5-10 hours into each edition so it means more than you will ever know!

This newsletter is for informational purposes only and does not constitute financial advice. Trading carries significant risk and may not be suitable for all investors. Past performance is not indicative of future results.

PAID SUBSCRIBER BONUS PLAY ⬇️

Keep reading with a 7-day free trial

Subscribe to Market Insights & Trading Trends to keep reading this post and get 7 days of free access to the full post archives.